Land Use Tax In Ethiopia . This paper examines the gender. The size of agricultural landholdings. Tax schedules vary by region. This paper examines the gender implications of these taxes using tax payment and individual land ownership data from the ethiopian. Economic theories provide a strong case for. Land use fees and agricultural income tax in ethiopia are levied on rural landholders according to. The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. This paper examines the gender. Revenue for local governments and it enables to use the rural land effectively and efficiently. The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. Real property taxation in general and rural land use fee and taxation in particular are important to generate revenue for local.

from www.ictd.ac

The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. This paper examines the gender implications of these taxes using tax payment and individual land ownership data from the ethiopian. The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. Real property taxation in general and rural land use fee and taxation in particular are important to generate revenue for local. Land use fees and agricultural income tax in ethiopia are levied on rural landholders according to. Economic theories provide a strong case for. Tax schedules vary by region. The size of agricultural landholdings. Revenue for local governments and it enables to use the rural land effectively and efficiently. This paper examines the gender.

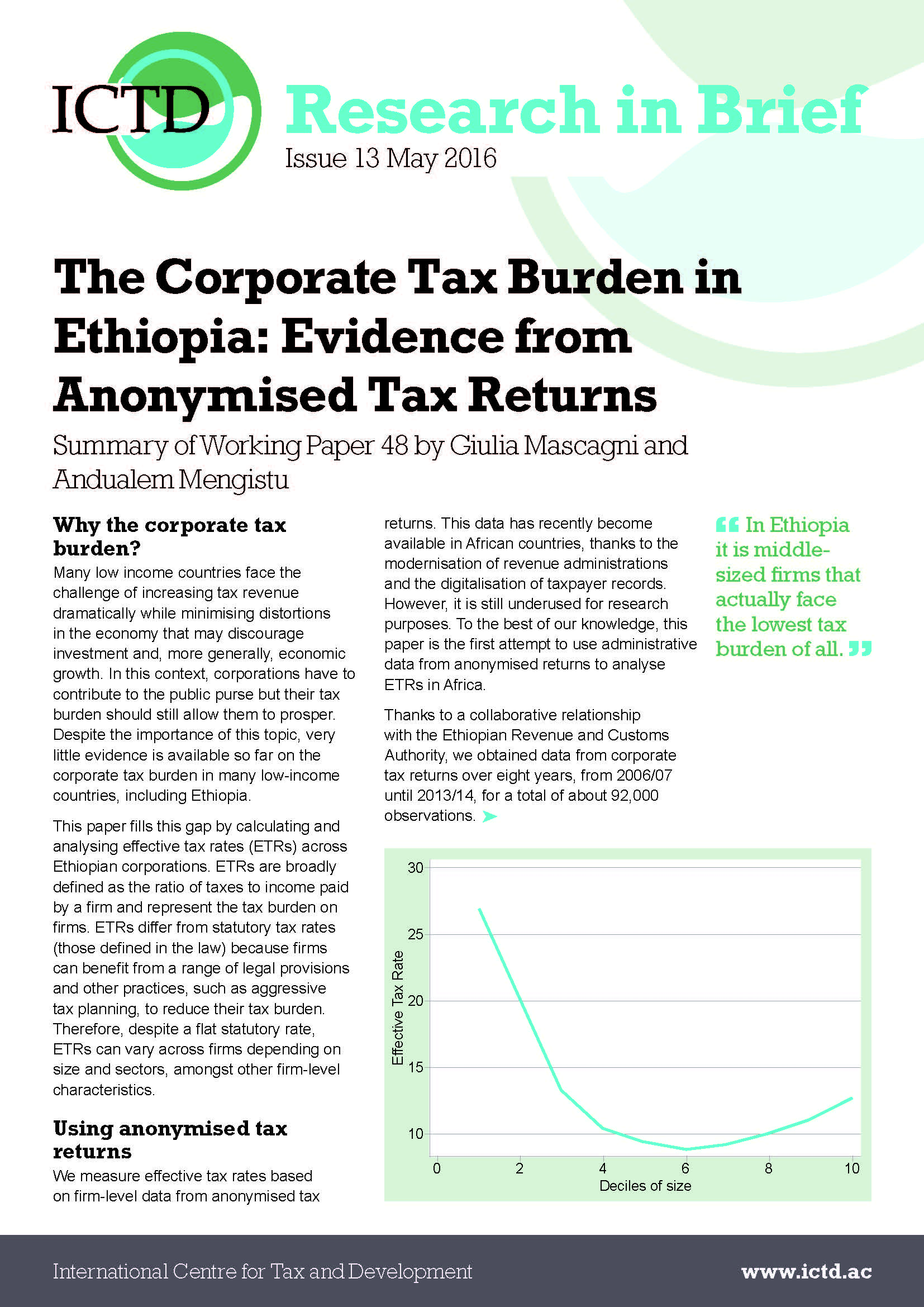

The Corporate Tax Burden in Ethiopia Evidence from Anonymised Tax

Land Use Tax In Ethiopia Economic theories provide a strong case for. This paper examines the gender. Real property taxation in general and rural land use fee and taxation in particular are important to generate revenue for local. The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. Economic theories provide a strong case for. Revenue for local governments and it enables to use the rural land effectively and efficiently. Tax schedules vary by region. This paper examines the gender. Land use fees and agricultural income tax in ethiopia are levied on rural landholders according to. The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. The size of agricultural landholdings. This paper examines the gender implications of these taxes using tax payment and individual land ownership data from the ethiopian.

From www.researchgate.net

SystemWide Impacts of Abolishing Ethiopia's Agricultural Export Taxes Land Use Tax In Ethiopia The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. This paper examines the gender. This paper examines the gender implications of these taxes using tax payment and individual land ownership data from the ethiopian. The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. Tax. Land Use Tax In Ethiopia.

From www.amazon.ca

Ethiopian Tax CalculatorAmazon.caAppstore for Android Land Use Tax In Ethiopia Land use fees and agricultural income tax in ethiopia are levied on rural landholders according to. The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. This paper examines the gender implications of these taxes using tax payment and individual land ownership data from the ethiopian. Revenue for local governments and it enables. Land Use Tax In Ethiopia.

From www.ictd.ac

The Corporate Tax Burden in Ethiopia Evidence from Anonymised Tax Land Use Tax In Ethiopia The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. This paper examines the gender. Revenue for local governments and it enables to use the rural land effectively and efficiently. The size of agricultural landholdings. Real. Land Use Tax In Ethiopia.

From www.youtube.com

Ethiopia አንዳንድ የህዝብ አስተያየት በነጋዴዎች የቀረጥ ጭማር አቤቱታ TAX Hike in Ethiopia Land Use Tax In Ethiopia The size of agricultural landholdings. This paper examines the gender implications of these taxes using tax payment and individual land ownership data from the ethiopian. Land use fees and agricultural income tax in ethiopia are levied on rural landholders according to. This paper examines the gender. Economic theories provide a strong case for. Real property taxation in general and rural. Land Use Tax In Ethiopia.

From www.theguardian.com

HMRC to help Ethiopia and Tanzania collect taxes HMRC The Guardian Land Use Tax In Ethiopia This paper examines the gender. Economic theories provide a strong case for. Land use fees and agricultural income tax in ethiopia are levied on rural landholders according to. The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. This paper examines the gender. This paper examines the gender implications of these taxes using. Land Use Tax In Ethiopia.

From tradingeconomics.com

Ethiopia Corporate Tax Rate 2022 Data 2023 Forecast 20042021 Land Use Tax In Ethiopia This paper examines the gender. This paper examines the gender implications of these taxes using tax payment and individual land ownership data from the ethiopian. The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. Tax schedules vary by region. Real property taxation in general and rural land use fee and taxation in. Land Use Tax In Ethiopia.

From www.withholdingform.net

Ethiopia Withholding Tax Declaration Form Land Use Tax In Ethiopia The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. Land use fees and agricultural income tax in ethiopia are levied on rural landholders according to. Real property taxation in general and rural land use fee and taxation in particular are important to generate revenue for local. Economic theories provide a strong case. Land Use Tax In Ethiopia.

From www.icalculator.info

Ethiopia Tax Rates and Thresholds in 2022 Land Use Tax In Ethiopia Land use fees and agricultural income tax in ethiopia are levied on rural landholders according to. Revenue for local governments and it enables to use the rural land effectively and efficiently. The size of agricultural landholdings. This paper examines the gender implications of these taxes using tax payment and individual land ownership data from the ethiopian. This paper examines the. Land Use Tax In Ethiopia.

From www.ictd.ac

Property taxation and economic development Lessons from Rwanda and Land Use Tax In Ethiopia The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. The size of agricultural landholdings. Tax schedules vary by region. Real property taxation in general and rural land use fee and taxation in particular are important to generate revenue for local. Economic theories provide a strong case for. The rural land use fee. Land Use Tax In Ethiopia.

From www.slideshare.net

Tax reforms and tax revenues performance in ethiopia Land Use Tax In Ethiopia Economic theories provide a strong case for. Real property taxation in general and rural land use fee and taxation in particular are important to generate revenue for local. The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. Revenue for local governments and it enables to use the rural land effectively and efficiently.. Land Use Tax In Ethiopia.

From www.ezega.com

Land with valid certificate and annual tax payment Addis Ababa Other Land Use Tax In Ethiopia This paper examines the gender. Tax schedules vary by region. The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. This paper examines the gender. The size of agricultural landholdings. This paper examines the gender implications. Land Use Tax In Ethiopia.

From www.studocu.com

Survey of the Ethiopian tax system TaxDev aims to contribute to more Land Use Tax In Ethiopia Land use fees and agricultural income tax in ethiopia are levied on rural landholders according to. The size of agricultural landholdings. Economic theories provide a strong case for. Real property taxation in general and rural land use fee and taxation in particular are important to generate revenue for local. This paper examines the gender implications of these taxes using tax. Land Use Tax In Ethiopia.

From www.scribd.com

Ethiopian Proclamation No. 2852002 Value Added Tax Taxes Value Land Use Tax In Ethiopia The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. This paper examines the gender. Real property taxation in general and rural land use fee and taxation in particular are important to generate revenue for local. Land use fees and agricultural income tax in ethiopia are levied on rural landholders according to. Revenue. Land Use Tax In Ethiopia.

From www.scribd.com

All Basic Information for Ethiopian Diaspora Identity Document Taxes Land Use Tax In Ethiopia Real property taxation in general and rural land use fee and taxation in particular are important to generate revenue for local. The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. This paper examines the gender.. Land Use Tax In Ethiopia.

From www.academia.edu

(PDF) A PROCLAMATION TO PROVIDE FOR THE ESTABLISHMENT OF THE ETHIOPIAN Land Use Tax In Ethiopia Land use fees and agricultural income tax in ethiopia are levied on rural landholders according to. Tax schedules vary by region. This paper examines the gender. Economic theories provide a strong case for. The size of agricultural landholdings. The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. Real property taxation in general. Land Use Tax In Ethiopia.

From www.youtube.com

How to prepare Payroll in Ethiopian Tax context ደመወዝ እንዴት እናዘጋጃለን Land Use Tax In Ethiopia This paper examines the gender. The size of agricultural landholdings. The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. Tax schedules vary by region. Real property taxation in general and rural land use fee and taxation in particular are important to generate revenue for local. This paper examines the gender. This paper. Land Use Tax In Ethiopia.

From www.academia.edu

(PDF) THE ETHIOPIAN TAX SYSTEM EXCESSES AND GAPS Ephrem Getachew Land Use Tax In Ethiopia This paper examines the gender implications of these taxes using tax payment and individual land ownership data from the ethiopian. Tax schedules vary by region. Land use fees and agricultural income tax in ethiopia are levied on rural landholders according to. Revenue for local governments and it enables to use the rural land effectively and efficiently. This paper examines the. Land Use Tax In Ethiopia.

From www.youtube.com

Tax in ethiopia 720p YouTube Land Use Tax In Ethiopia Economic theories provide a strong case for. The rural land use fee and agricultural income tax are major payments for rural landholders in ethiopia. This paper examines the gender. This paper examines the gender. Real property taxation in general and rural land use fee and taxation in particular are important to generate revenue for local. Land use fees and agricultural. Land Use Tax In Ethiopia.